Financial Strategy

Basic policy

The investment corporation has established the following policy in order to ensure stable financial management.

- Equity finance

- With the aim of achieving long-term, stable growth, the issuance of additional investment units will be carried out flexibly, taking into consideration a multitude of factors including the timing of the acquisition of newly-acquired real estate-related assets and the possibility of utilizing the sponsor’s warehousing capabilities, LTV, the timing for the repayment of interest-bearing debt and the period remaining until repayment, as well as economic conditions, while also considering the dilution of the rights of existing investors and the resulting decline, etc. in the trading price of investment units.

- Debt finance

- When borrowing funds or issuing investment corporation bonds, the investment corporation considers the balance between financing flexibility and financial stability, and looks at the long-term ratio, fixed ratio, the diversification of repayment due dates, funding methods (borrowings, investment corporation bonds), and the establishment of commitment lines, etc.

- LTV

- In principal, LTV is not to exceed 65%, taking notice of funding reserves. However, LTV may temporarily exceed 65% as a result of new investments and fluctuations in asset valuations.

Effective use of internal reserves

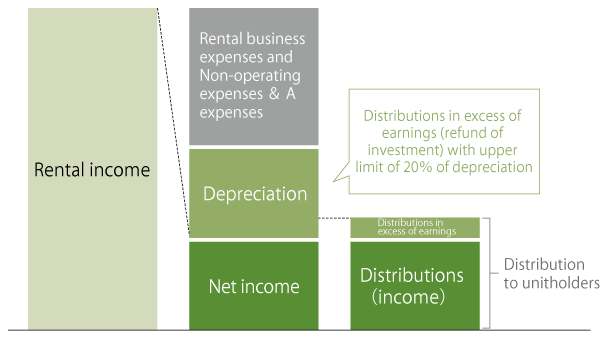

The investment corporation seeks to maximize per unit distributions by effectively utilizing internal reserves equivalent to the amount of depreciation and amortization.

- Enhancing the competitiveness of owned facilities by using internal reserves for renovations, repairs and capital expenditure

- Reducing interest costs by allocating internal reserves to cover a portion of the funds to repay borrowings

- Enhancing rental income by allocating internal reserves to cover a portion of the acquisition funds for newly-acquired properties

- Distribution of excess earnings

- Acquisition of treasury investment units

Implementation of distributions in excess of earnings

The amount of distribution in excess of earnings per unit is calculated pursuant to the policies provided in the Articles of Incorporation of the Investment Corporation, policies provided below, other applicable laws and regulations, rules of self-regulatory organizations, etc.

The total amount of distribution in excess of earnings is distributed up to the amount equivalent to 20/100 of the depreciation recorded in the calculation period immediately before the calculation period when the Investment Corporation will pay the said distribution, sufficiently taking into consideration the amount of capital expenditure necessary for maintaining and improving the competitiveness of the Investment Corporation’s Assets Under Management and the financial position of the Investment Corporation.

However, distribution in excess of earnings may be conducted up to an amount lower than the above amount or may not be conducted when the implementation of distribution in excess of earnings up to the said amount (Note1) s judged to be inappropriate based on the economic environment surrounding the Investment Corporation, trends of the real estate market and leasing market, status of the Investment Corporation’s Assets Under Management and financial conditions.

| (Note1) | Under the rules of The Investment Trusts Association, closed-end investment corporations are allowed to conduct distribution in excess of earnings up to an amount equivalent to 60/100 of the depreciation recorded on the last day of the calculation period. |

|---|

<Distributions in excess of earnings>

- Related Links

- Interest-Bearing Debt

- Loans

- Investment Corporation Bonds