Governance

- Governance System to Ensure Appropriate Asset Management

- Initiatives at HCM and HAM

- Compliance and Risk Management Systems

Governance System to Ensure Appropriate Asset Management

Corporate Governance

- HCM &

HAM

Corporate Governance

The institutional operation of Healthcare & Medical Investment Corporation (hereinafter, “HCM”) is conducted by the General Meeting of Unitholders comprised of HCM’s unitholders in addition to the Board of Directors comprised of one executive director and two supervisory directors, as well as the accounting auditor.

Directors’ compensations are stipulated by the Articles of Incorporation. The maximum compensation for the executive director is 500,000 yen per month per person and the monthly compensation is determined by the Board of Directors. The maximum compensation for the supervisory directors is 500,000 yen per month per person and the monthly compensation is determined by the Board of Directors.

Furthermore, as employment is forbidden to HCM by the Act on Investment Trusts and Investment Corporations, HCM does not employ any employees but entrusts the management of its assets to Healthcare Asset Management Co., Ltd. (hereinafter, “HAM”).

Separation of Executive Director of HCM and President & CEO of HAM

From November 1, 2020, the system in which President & CEO of HAM concurrently serves as executive director of HCM was dissolved.

Board of Directors Meetings, Executive Director and Supervisory Director

The supervisory directors were replaced at the General Meeting of Unitholders held in October 2022. Supervisory Director Shida, who served four terms, retired and Supervisory Director Sato was appointed. The executive directors and supervisory directors attended all board meetings held.

| Title | Name | Profession・ Expertise |

Gender | Years in office | Status of Attendance in Board of Directors Meetings |

|---|---|---|---|---|---|

| Executive Director | Yuji Fujise | Shimada Hamba & Osajima Lawyer | Male | 2 years and 5 month |

15 times/15times (100%) |

| Supervisory Director | Sachihiko Fujimoto | Hayabusa Asuka Law Offices Counsel, Certified public accountant | Male | 8 years and 4 month |

15 times/15times (100%) |

| Supervisory Director | Kaori Sato | Torikai Law Office Partner, Lawyer | Female | 5 month | 6 times/6times (100%) |

| [Reference: Information on Former Supervisory Directors (Dec 2014 to Oct 2022)] | |||||

| Previous Supervisory Director | Yasuo Shida | Blakemore & Mitsuki Partner, Lawyer | Male | 7 years and 11 month |

9 times/9times (100%) |

| (Note 1) | The term of office is from the time of appointment to the end of March 2023. |

|---|---|

| (Note 2) | The number of board meetings attended is based on the actual number of board meetings held from April 2022 to March 2023 during the tenure of each director. |

Appropriate Management of Conflicts of Interest

- ▪Related party is defined in broader terms than interested party, etc. under the Investment Trust Law, and established a system to carry out transactions after conducting rigorousexaminations.

- ▪For details of the decision-making process, please refer to “Decision-Making Flow Concerning Acquisition of Assets Under Management".

- ▪Fee for property acquisition from related party or property transfer to related party Acquisition or transfer price × 0.5%(usually 1.0%)is upper limit.

Compensation for the Asset Management Company

| Total compensation | |

|---|---|

| 15th Fiscal Period (ended Jul.2022) |

16th Fiscal Period (ended Jan.202) |

| 203,435 thousand yen | 246,843 thousand yen |

| (Note) | Apart from the above, 66,960 thousand yen of asset management fees were generated in the 15th fiscal period (ended Jul. 2022) and 27,040 thousand yen of asset management fees were generated in the 16th fiscal period (ended Jan. 2023) for property acquisition or disposition included in the book value of real estate, etc. |

|---|

Compensation for the Auditor

| Title | Name | Total compensation | |

|---|---|---|---|

| 15th Fiscal Period (ended Jul.2022) |

16th Fiscal Period (ended Jan.2023) |

||

| Accounting auditor | PricewaterhouseCoopers Arata LLC | 14,000 thousand yen | 11,000 thousand yen |

Compensation for the Directors

| Title | Name | 14th Fiscal Period (ended Jan. 2022) |

15th Fiscal Period (ended Jul.2022) |

16th Fiscal Period (ended Jan.2023) |

|||

|---|---|---|---|---|---|---|---|

| Monthly Compensation | Total Compensation | Monthly Compensation | Total Compensation | Monthly Compensation | Total Compensation | ||

| Executive Director | Yuji Fujise | 300 thousand yen |

1,800 thousand yen |

300 thousand yen |

1,800 thousand yen |

300 thousand yen (Note) |

2,100 thousand yen |

| Supervisory Director | Sachihiko Fujimoto | 250 thousand yen |

1,500 thousand yen |

250 thousand yen |

1,500 thousand yen |

250 thousand yen |

1,500 thousand yen |

| Supervisory Director | Kaori Sato | ― | ― | ― | ― | 250 thousand yen |

750 thousand yen |

| [Reference: Information on Former Supervisory Directors (Dec 2014 to Oct 2022)] | |||||||

| Previous Supervisory Director | Yasuo Shida | 250 thousand yen |

1,500 thousand yen |

250 thousand yen |

1,500 thousand yen |

250 thousand yen |

750 thousand yen |

| (Note) | Monthly compensation for executive directors has changed to 400 thousand yen since November 2022. |

|---|

Initiatives at HCM and HAM

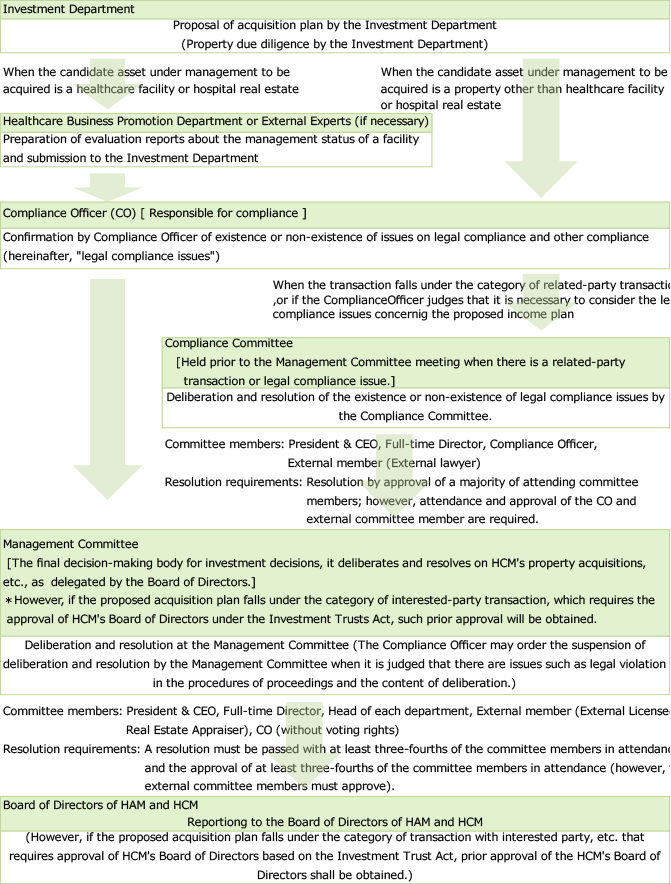

Decision-Making Flow Concerning Acquisition of Assets Under Management

External Members of the Management Committee and Compliance Committee

The members of HAM’s Management Committee and Compliance Committee are comprised of outside experts selected by the Board of Directors. Checks for conflicts of interest are set in place and the fairness, objectivity and validity of the committees’ decision making are ensured. The external members of the Management Committee and Compliance Committee are as follows.

Compliance Committee

| Title | Name | Gender | Profession/ Title | voting right | veto right |

|---|---|---|---|---|---|

| Chairperson | Hiroyuki Matsumoto | Male | HAM/ Compliance Officer | ○ | ○ |

| External member | Eriko Matsuno | Female | Attorney/ Tokyo J Law Offices Representative | ○ | ○ |

| Member | Seiji Yoshioka | Male | HAM/ Representative Director | ○ | - |

| Member | Kyosuke Umezu | Male | HAM/ Full-time Director | ○ | - |

| Member | Atsushi Tanno | Male | HAM/ Director and Chief Investment Officer | ○ | - |

Resolution requirements: Resolution by approval of a majority of attending committee members; however, attendance and approval of the CO and external committee member are required.

Management Committee

| Title | Name | Gender | Profession/ Title | voting right | veto right |

|---|---|---|---|---|---|

| Chairperson | Seij Yoshioka | Male | HAM/ Representative Director | ○ | - |

| External member | Toshiko Okamura | Female | Licensed Real Estate Appraiser/ Toukatsu Real Estate Appriasal Representative | ○ | ○ |

| Member | Kyosuke Umezu | Male | HAM/ Full-time Director | ○ | - |

| Member | Atsushi Tanno | Male | HAM/ Director and Chief Investment Officer | ○ | - |

| Member | Atsumasa Furuya | Male | HAM/ Head of Finance & Administration Department | ○ | - |

| Member | Kazushige Endo | Male | HAM/ Chief Asset Management Officer | ○ | - |

| Member | Noboru Kushige | Male | HAM/ Chief Healthcare Business Promotion Officer | ○ | - |

| Member | Hiroyuki Matsumoto | Male | HAM/ Compliance Officer | - | ○ |

Resolution requirements: A resolution must be passed with at least three-fourths of the committee members in attendance and the approval of at least three-fourths of the committee members in attendance (however, the external committee member must approve).

Ratio of Women and Independent third party (Outside) Members in Each Committee

| Meeting structure | Ratio of Women | Ratio of External (Outside) Members | |

|---|---|---|---|

| HCM | Board of Directors | 33.3% | 66.7% |

| HAM | Board of Directors | 0.0% | 0.0% |

| Management Committee | 12.5% | 12.5% | |

| Compliance Committee | 20.0% | 20.0% |

| (Note) | The independent third party (outside) ratio is the ratio of outside officers and committee members who are independent from the shareholders of the HAM. Independence is determined in accordance with the requirements for outside directors as stipulated in Article 2, Paragraph 15 of the Companies Act. |

|---|

Compliance and Risk Management Systems

Compliance

- HCM &

HAM

Compliance System

HAM, fully cognizant of the significance of the fact that the asset management it conducts with the assets of HCM constitutes the management of the funds of HCM’s unitholder, in order to ensure the development of an appropriate management structure, has set up the Compliance Office as a division responsible for matters pertaining to compliance of HAM, and has appointed a Compliance Officer as an individual responsible for supervising matters pertaining to compliance, thereby ensuring the effectiveness of the function of internal oversight of other departments. The appointment or the dismissal of the Compliance Officer will be processed through the resolution of the Board of Directors.

The Compliance Officer, as the key person responsible for compliance at HAM, is charged with establishing and maintaining the internal compliance structure of the company and raising the level of standards awareness within the company with regard to compliance with all applicable laws and rules. Also, the Compliance Officer will promote awareness of compliance of executives and employees and disseminate compliance through the planning and implementation of compliance trainings for executives and employees. To those ends, the Compliance Officer continually monitors to ensure that all operations conducted for the asset management of HCM by HAM comply with all applicable laws and the Articles of Incorporation of HCM, and exercises supervision over the overall internal compliance environment in daily operations.

In view of the importance of the duties of the Compliance Officer, only a person having adequate investigative and supervisory capacity for ensuring compliance with all applicable laws, regulations and rules will be appointed as the Compliance Officer.

Formulation and Execution of the Compliance Manual

In order to ensure thorough compliance with laws, etc. (referring to laws, ordinances, regulations and other orders HAM must observe in executing operations, the regulations of the Investment Trusts Association, Japan (the “Investment Trusts Association”), the regulations of the financial instruments exchange to which HCM is listed, the Articles of Incorporation of HCM, the Articles of Incorporation and in-house rules of HAM and the agreements concluded by HAM based on such (including asset management entrustment agreements), etc.), HAM has established the Compliance Rules and the Compliance Manual, has formulated the Compliance Program, which is a concrete practice plan for realizing compliance with laws, etc., and will strive to implement compliance with laws, etc. in accordance with the program.

Initiatives to Prevent Corruption, Eliminate Anti-Social Forces, and Prevent Money Laundering and Terrorist Funding

HAM has established a system to strictly prohibit and prevent corruption, such as bribery, money laundering, embezzlement, and other violations of the law. This includes the establishment of the Rules on Prevention of Bribery, Reception of Gifts and Rules on Handling of Verifications on Transactions.

As a basic policy for eliminating anti-social forces, HAM stipulates that “it will sever any ties whatsoever with anti-social forces, reject unjust demands from them, engage in no backroom deals with and provide no funds to them, and, if necessary, take legal action against them and adopt a company-wide response to anti-social forces while collaborating with specialized external organizations.”

Based on this basic policy, HAM severs all ties with anti-social forces, ensures appropriate management of HAM, and prevents significant harm to stakeholders, including executives and employees, and shareholders, and with the aim of fulfilling HAM’s social responsibilities, it has established Regulations for Eliminating Anti-Social Forces and Manual for Eliminating Anti-Social Forces, etc., which stipulate policies and specific procedures for handling their elimination.

Furthermore, it has established a department for handling anti-social forces and a supervisory officer, and through internal compliance training, it aims to comprehensively inform all executives and employees about the policies for eliminating anti-social forces and the methods of handling them.

Establishment of Internal Reporting System

HAM has established a system for consultation and appropriate handling of reports related to violations and other questionable acts or facts in relation to laws and other societal standards and the Compliance Manual (compliance-related information). Both internal and external points of contact are in place.

Compliance workshops

In order to foster and improve self-directed compliance awareness, we hold monthly compliance workshops and rigorously implement customer-oriented business operations (fiduciary duty) for all executives and employees.

Risk Management

- HCM &

HAM

Risk Management

With regard to the various risks concerning investment management, HCM observes the rules stipulated in the Investment Trust Act and other related laws and regulations. Also, HAM establishes appropriate company regulations for such risks, sets forth necessary organizational structures and educates executives and employees in order to enhance their mindfulness of compliance, among other measures.

The specific initiatives are as follows.

A. HCM

HCM is managed by the Board of Directors comprised of one executive director and two supervisory directors. The Board of Directors convenes at least once every three months as necessary to pass resolutions pertaining to matters stipulated by law and HCM’s Board of Directors’ Rules and report on the status of execution of operations by HAM and executive director of HCM. This system enables supervisory directors that are independent from HAM and interested parties, etc. to supervise the status of execution of operations. Also, the supervisory directors may request reports concerning the operations and financial status of HCM from HAM, the asset custody company, etc. and conduct necessary investigations.

B. HAM

In order to appropriately manage various risks, HAM has formulated the Risk Management Rules as company regulations, stipulating that significant risks must be reported to the Board of Directors without delay. Additionally, HAM has formulated the Related Party Transaction Rules in order to prevent harm to the interests of HCM, thereby establishing strict rules against conflicts of interest. Regarding compliance, HAM has established the Compliance Regulations and the Compliance Manual to promote thorough legal compliance, has formulated the Compliance Program, which is a concrete practice plan for realizing compliance with laws, etc., and will strive to implement compliance with laws, etc. in accordance with the program.

Furthermore, HAM has formulated the Internal Audit Rules to secure adequacy of operations and promote efficient management, thereby establishing a self-monitoring system.

Internal Audits

A. Organization and Details of Internal Audits

The internal audits of HAM are conducted by the Internal Audit Office and Internal Audit Office Manager. Moreover, when the Compliance Officer also occupies the post of Internal Audit Office Manager, the Head of Financial & Administration Department shall have authority over and owe duty for internal audits concerning the operations of the Compliance Officer and Compliance Office.

(The person appointed to the post of Head of Financial & Administration Department shall be one with sufficient knowledge and experience for proper execution of internal audits of the Compliance Officer and Compliance Office.)

The internal audits will target all organizations and divisions and their operations.

The Internal Audit Division formulates an internal audit plan upon understanding the conditions of internal management, risk management, etc. of audited divisions. In principle, internal audits shall be conducted based on the internal audit plan at least once a year (periodic audits). However, audits will also be conducted by special order of the Representative Director (special audits). Special audits shall be prescribed by the Representative Director when it is recognized to be particularly necessary in cases where, during an internal audit plan’s target period, facts contrary to the conditions of internal management, risk management, etc. of audited divisions grasped as of the formulation of the internal audit plan come to light.

When internal audits are being conducted, each division must present and explain documents, registers, etc. to the Internal Audit Office and Internal Audit Office Manager as requested and cooperate for the smooth implementation of the audit.

B. Remedial Measures Based on Results of Internal Audits

The Internal Audit Office and Internal Audit Office Manager shall notify the audited divisions of the audit results. The Representative Director may issue recommendations for improvement to an audited division in light of the audit results. The audited division shall then prepare an improvement plan and, having effected the improvement, report to the Representative Director and Internal Audit Office Manager with regard to the status of improvement. The Representative Director and Internal Audit Office Manager shall then deliberate the content of the report, thereby confirming the effective functioning of the internal audit.

BCP Measures

In preparation for emergency situations that may occur in the course of management of HCM’s assets due primarily to large-scale earthquakes, fires, typhoons, storms, flooding, abnormal weather and other natural disasters, other man-made disasters such as terrorist attacks and cyberattacks, infectious diseases such as novel influenza viruses or damage/disruption of lifelines, HAM has established a Crisis Management Manual for a policy of measures of preparation, ensuring of chain-of-command, prevention of spread of damage and continuation of important operations for the purpose of promptly ensuring the safety of executives and employees, reducing risk and damage, preventing an increase of loss for unitholders and stakeholders, ensuring continuation of important operations and early recovery, etc.

Also, HAM’s office, general warehouse, etc. are equipped with three days’ worth of emergency food and water for executives and employees and other stockpiles and equipment.

Confirmation of Safety

In order to quickly grasp the situation and safety of executives and employees in a disaster, HAM has introduced a system of confirming safety using the internet and emails as part of the companyʼs crisis management strategy. Safety confirmation trainings are conducted at least once a year. The participation rate in fiscal 2022 was 100%.