Sustainability Management

- Top Message

- Basic Policy on ESG

- ESG Promotion System (ESG Leadership)

- Materiality

- Initiatives / External Certifications

Top Message

Healthcare & Medical Investment Corporation

Executive Director

Yuji Fujise

Healthcare Asset Management Co., Ltd.

President & CEO

Seiji Yoshioka

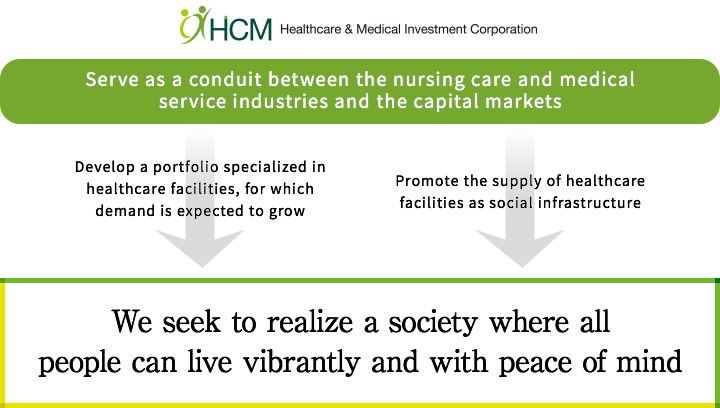

Healthcare & Medical Investment Corporation (hereinafter, “HCM”) and Healthcare Asset Management Co., Ltd. (hereinafter, “HAM”), the Asset Management Company, aim to serve as a conduit between the nursing care and medical service industries in which social needs are expected to increase and the capital markets, based on the environmental awareness that upgrading and expansion of healthcare facilities is further required in order to respond to the growing demand for medical and nursing care services. In other words, HCM and HAM aim to realize a society where all people can live vibrantly and with peace of mind as well as secure stable revenue and achieve steady growth of assets under management by promoting appropriate maintenance and management and new supply of healthcare facilities through stable investment and ownership of healthcare facilities with the keywords of “nursing care," “medical service” and “health."

Basic Policy on ESG

Basic Philosophy

In order to realize a “society where all people can live vibrantly and with peace of mind," which is the investment philosophy of HCM, HAM aims to contribute to the aged society and maximize unitholder value over the medium to long term through the promotion of provision of healthcare facilities as social infrastructure and construction of a portfolio specializing in healthcare facilities.

HAM will collaborate with various in-house/outside stakeholders including operators, hospital personnel, the sponsors and executives and employees of HAM in order to practice asset management in consideration of ESG including the reduction of environmental burden, efforts toward resolution of social issues in an aged society and establishment of governance system.

Reducing the Environmental Burden

HCM strives for energy conservation and reduction of CO2 emissions by improving energy efficiency at its properties and introducing facilities that contribute to energy saving. Also, HCM aims for resource conservation and waste reduction with regard to capital expenditure of its properties and in the formulation and implementation of their repair plans.

Initiatives for Solving the Challenges of an Aged Society

HAM believes that HCM’s continuous investment in healthcare facilities and its stable management of assets will help towards solving the social challenges of an aged society. Therefore, HAM has cooperated with various internal and external stakeholders including unitholders, operators, hospital personnel, the sponsors, executives and employees.

(1) Initiatives in Collaboration with Operators and Hospital Personnel

HAM establishes intimate relationships of trust with operators of healthcare facilities and hospital personnel through dialogue, strives to grasp the operating conditions of HCM’s healthcare facilities and conducts asset management which is considerate towards the safety and security of users as well as the environment.

Additionally, in light of the heightened social awareness of the working environment of healthcare facility employees and healthcare professionals, HCM announces its efforts of improvement for operators of its healthcare facilities and hospital personnel in a way that is easy to understand, thereby deepening the understanding of unitholders.

(2) Initiatives in Collaboration with the Sponsors

HAM collaborates with its sponsors which have sophisticated expertise in nursing care/medical service, fund management and finance as it works to solve the challenges of an aged society and increase unitholder value through HCM’s stable management of assets and the medium- to long-term growth of its portfolio.

(3) Initiatives in Collaboration with Executives and Employees

HAM will strive to provide a healthy and comfortable work environment for our executives and employees so that they can maximize their potential, and HAM will proactively work to develop human resources through specialized education and training support. In addition, in order to implement the Basic Policy, HAM will continue to provide training on ESG to our executives and employees to raise their ESG awareness.

(4) Initiatives in Collaboration with Outsourcing Contractors and Other Business Partners

HAM seeks the understanding and cooperation of outsourcing contractors and other business partners with regard to ESG initiatives and promotes measures in line with the Basic Policy.

(5) Contribution to Local Communities

Through HCM’s asset management HAM will contribute to the improvement in the sufficiency rate of healthcare facilities in local communities and the realization of a regional healthcare vision.

Establishing a Governance Framework

HAM endeavors to put in place in-house structures, company regulations, etc. in order to promote the establishment of an autonomous compliance framework and governance framework.

(1) Establishment of an Autonomous Compliance Framework

In order to establish an autonomous compliance framework for executives and employees, HAM holds internal and external trainings on a continued basis in order to deepen understanding of laws required for operations and other rules.

(2) Establishment of a Governance Framework

For the strengthening of governance as well as accomplishing appropriate risk management, HAM puts in place in-house structures such as the establishment of various council bodies and formulation of company regulations, thereby securing transparency of decision making, avoiding conflict of interest and reducing a variety of risks.

Disclosure of Information to Unitholders and Other Stakeholders

HAM actively discloses information concerning the reduction of the environmental burden, initiatives for the resolution of social challenges of an aged society and the establishment of governance frameworks to its stakeholders and others, thereby contributing to the sustainable growth of HCM through deepening the understanding of unitholders and other stakeholders.

ESG Promotion System (ESG Leadership)

HAM designates the chief officer and executive officers on sustainability as follows.

| Chief Officer of Sustainability |

President & CEO |

|

|---|---|---|

| Executive Officer of Sustainability Performance |

Head of Asset Management Department |

|

| Executive Officer of Sustainability Management |

Head of Finance & Administration Department |

|

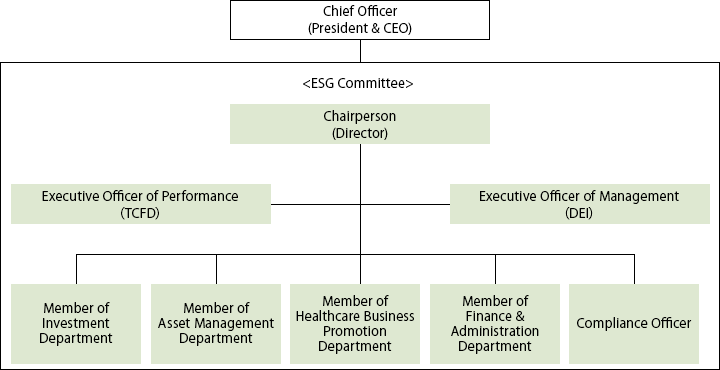

Furthermore, HAM has established an ESG Committee which deliberates and drafts various policies, targets and measures regarding sustainability.

Organization Chart (as of March 2023)

ESG Committee

| Chairperson | Director |

|---|---|

| Members | (1) Director (2) Executive Officer of Performance (3) Executive Officer of Management (4) Member of Asset Management Department (5) Member of Investment Department (6) Member of Finance & Administration Department (7) Member of Healthcare Business Promotion Department (8) Compliance Officer (9) Other person appointed by the Chairperson |

| Frequency of meeting | At least once a month in principle |

- ・The Committee reports to the Chief Officer of Sustainability and Executive Officer of Sustainability Management with regard to various policies, targets, measures, etc. at least once every three months.

- ・The committee reports to the Board of Directors at least once a year on various policies, targets and measures.

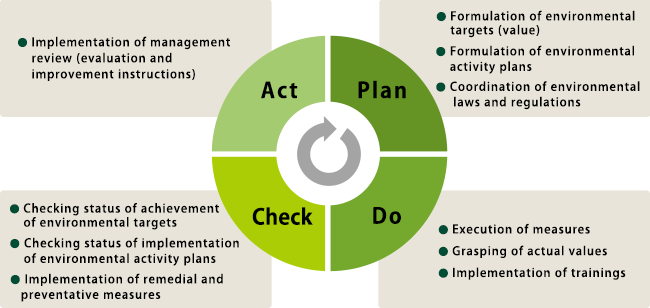

Promotion Process (PDCA Cycle)

Number of Meetings by the ESG Committee

| Fiscal 2021 | Fiscal 2022 | |

|---|---|---|

| Number of ESG Committee held | 3 times | 16 times |

| Number of Management review | 1 time | 1 time |

| Number of in house ESG training held / Participation rate | Twice/100% |

For all executives and employees : Once/100% For ESG committee members : Twice/100% |

Materiality

HCM and HAM aim to realize the investment philosophy and enhance unitholder value over the medium to long term by practicing asset management that is considerate of ESG (Environment, Social and Governance).

| Issues that need to be solved | Highly relevant SDGs | |

|---|---|---|

| Environment |

|

|

| Social |

|

|

| Governance |

|

|

| (Source) | Excerpt from the United Nations Information Centre's "SDGs Posters, Logos, Icons and Guidelines" |

|---|

Initiatives / External Certifications

TCFD Recommendations

In March 2023, HAM announced its support for TCFD (Task Force on Climate-related Financial Disclosure) and participated in the TCFD Consortium, an organization of domestic TCFD supporting companies.

GRESB Real Estate Assessment

HCM acquired the status of "2 stars" and "Green Star" for the 2023

GRESB Real Estate Assessment HCM also received the highest "A Level" for the GRESB Public Disclosure.

BELS Evaluation

The following HCM properties have been rated by BELS(Building-housing Energy-efficiency Labeling System)

- NOAH GARDEN L Grace

- NOAH GARDEN Season Bell