Social Finance

- SDGs Social Finance Framework

- JCR Social Finance Evaluation

- Status of Allocation of Social Loan and Social Bond

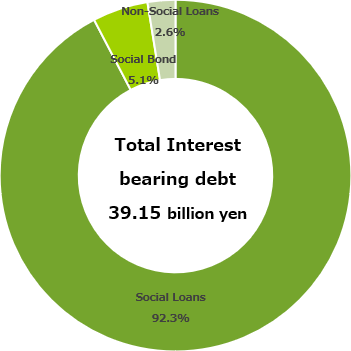

- Status of Social Finance (as of the end of January,2023)

SDGs Social Finance Framework

What Is Social Finance?

Social Finance refers to finance with issuance of bonds and loans “that raise funds for new and existing projects with positive social outcomes.” Specifically, it is a financing approach where (i) The use of funds is limited to projects with a high degree of contribution to society, (ii) The

funds are reliably tracked and managed, and (iii) Transparency is secured through reporting after the fund-raising.

ESG financing is showing signs of spreading to various financing tools rather than just bonds in recent years. There is already encouragement being explicitly made for investment in various financial instruments, such as the “Green Loan Principles” published by the Loan Market Association for green projects.

In the “Recommendation from the High Level Meeting on ESG Finance - Toward becoming a big power in ESG finance-” announced by the Ministry of the Environment on July 27, 2018, promotion of ESG financing that have ESG and SDG contributions as the use of proceeds has been incorporated as follows:

“We understand that a strategic shift toward a decarbonized, sustainable society is exactly the source of Japan’s competitiveness and “new growth,” as both the Paris Agreement and Sustainable Development Goals (SDGs) pursue such a society. Against this backdrop, we have confirmed that it is essential to develop ESG investments, which are being accelerated ahead in direct finance, into those with a larger social impact, and to realize ESG financing in indirect finance as well through collaborations between regional financial institutions and local governments, etc. with financial institutions’ responses to the global trend in mind… Given Japan’s financial structure centered on indirect finance, encouraging considerations to ESG in loan will also be a key to expansion of sustainable and inclusive ESG finance.”

Establishment of SDGs Social Finance Framework

Healthcare Asset Management Co., Ltd. (hereinafter, “HAM”) established the SDGs Social Finance Framework limiting the use of funds to investments with a high degree of social contribution when Healthcare & Medical Investment Corporation (hereinafter, “HCM”) raises funds through borrowings or issuance of bonds as social finance as well as defining the confirmation and management system of the status of allocation of procured funds and reporting system of the effect of social contribution, etc.

The framework limits the use of funds procured from social financing to new investments in healthcare facilities and refinancing. In addition, it also defines the criteria and process of project selection, fund management method, status of allocation of funds and reporting on social outcome.

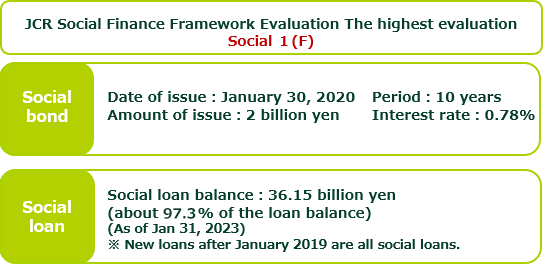

JCR Social Finance Evaluation

What Is JCR Social Finance Evaluation?

JCR Social Finance Evaluation is an evaluation performed by Japan Credit Rating Agency, Ltd. (hereinafter, “JCR”) by confirming that the use of funds are in alignment with the Social Finance components of the principles published by the International Capital Market Association (ICMA) and consistent with the SDGs. In the confirmation and evaluation, the "Social Bond Principles" and "Mapping of SDGs and Social Project Categories" published by ICMA are used as reference indicators in the evaluation, and such include the "Social Finance Framework Evaluation," an evaluation for the framework of fund procurement, “Social Loan Evaluation," an evaluation for borrowings, and “Social Bond Evaluation," an evaluation for bonds.

Acquisition of First Social Finance Evaluation by a J-REIT

HCM was the first J-REIT to acquire social finance evaluation by JCR for the social finance framework and the social loans through which funds were procured in February 2019 (total of 11.75 billion yen). The impact of HCM’s businesses on the society, the management method of the procured funds, the information disclosure system, etc. were highly evaluated, and HCM received the highest evaluation for each item. For details, please refer to the evaluation report on JCR’s website.

| Evaluation item | Result |

|---|---|

| Social Finance Framework Evaluation | Social1 (F) |

| Social Loan Evaluation | Social1 |

JCR Website

https://www.jcr.co.jp/en/

First issuance of social bond of HCM

When the refinancing in January 2020 , HCM issued the Social Bond for the first time with an aim to expand fund procurement methods by the expansion of its investor base which is proactively conducting ESG investment, as well as to improve unitholder value over the medium to long term by contribution to the realization of a sustainable society set in the SDGs.

| Actions | Targets of SDGs | Expected effects of social contribution |

|---|---|---|

| Continuous investment in healthcare facilities and stable asset management |

|

・Elimination of the shortage of housing for the elderly against the elderly population ・Promotion of earthquake resistance at hospitals ・Promotion of the shift of hospital functions to realize a sustainable society |

|

・Promotion of social advancement of women who were forced to leave their jobs to be engaged in nursing care by promoting the supply of nursing care facilities |

|

|

・Reduction of work burden of nursing care staff through ICT system investments in nursing care facilities |

Status of Allocation of Social Loan and Social Bond

Status of Use and Procurement of Funds (February 1, 2022 - January 31, 2023)

| Use of funds | Fund procurement | ||

|---|---|---|---|

| Acquisition of healthcare facilities | 11.94 billion yen | Social loan | 15.75 billion yen |

| Refinancing | 9.75 billion yen | Social bond | - |

| Expenses, etc. (Note) | - | Own funds, etc. | 5.94 billion yen |

| Total | 21.69 billion yen | Total | 21.69 billion yen |

| (Note) | Expenses include research expenses, investment unit issuance expenses, loan fees, etc. associated with property acquisition. |

|---|

List of Social Loans and Social Bond(February 1, 2022 - January 31, 2023)

HCM procured 5.5 billion yen on March 30, 2022, and 0.5 billion yen on September 30, 2022 , and 9.75 billion yen on January 31, 2023 and allocated the entire amount as funds for financing borrowings associated with the acquisition of trust beneficiary rights for healthcare facilities and refinancing such borrowings.

List of Social Loans

| Lender | Borrowing amount | Interest rate | Drawdown date | Repayment date | Repayment method | Security | |

|---|---|---|---|---|---|---|---|

| SMBC | 2 billion yen |

3-month TIBOR+0.25% |

March 30, 2022 | March 30, 2023 | Lump-sum repayment on principal repayment date | Unsecured Unguaranteed |

|

| Loan syndicate with Sumitomo Mitsui Banking Corporation as an arranger | 0.7 billion yen |

3-month TIBOR+0.35% |

March 30, 2022 | January 31, 2026 | |||

| 2.8 billion yen |

3-month TIBOR+0.55% |

January 31, 2028 | |||||

| SMBC | 0.5 billion yen |

3-month TIBOR+0.25% |

September 30, 2022 | January 31, 2023 | |||

| Loan syndicate with Sumitomo Mitsui Banking Corporation as an arranger | 2.5 billion yen |

Fixed interest rate | January 31, 2023 | January 31, 2026 | |||

| 3.25 billion yen |

3-month TIBOR+0.45% |

January 31, 2028 | |||||

| 4 billion yen |

3-month TIBOR+0.55% |

January 31, 2029 | |||||

| Total | 15.75 billion yen |

||||||

Status of Use and Allocation of Funds

| Use of Funds | Allocation ratio | Unallocated amount |

|---|---|---|

| Funds for acquisition of healthcare facilities (including trust beneficiary rights) | 38.1% | None |

| Funds for refinancing | 61.9% |

Borrowings for Refinancing

| Lender | Balance | Drawdown date | Refinancing date |

|---|---|---|---|

| SMBC | 0.5 billion yen | September 30, 2022 | January 31, 2023 |

| Loan syndicate with Sumitomo Mitsui Banking Corporation as an arranger | 4 billion yen | March 20, 2018 | |

| 4 billion yen | February 1, 2019 | ||

| 1.25 billion yen | January 31, 2020 | ||

| Total | 9.75 billion yen | ||

Initial use of funds

- ▪The above loans are allocated the entire amount as funds for financing borrowings associated with the acquisition of healthcare facilities and refinancing such borrowings.

Status of Social Finance (as of the end of January,2023)

Social loans accounted for 36.15 billion yen (92.3%) and social bonds for 2.0 billion yen (5.1%) of total interest-bearing debt as of the end of January 2023, for a total of 38.15 billion yen (97.4%) procured through social finance.